Soon after a brutal yr in 2022, the S&P 500 (SPY) ripped greater to start off the yr-only to give a lot of the gains again. Working with a continual hand to steer by the each day volatility is however a very practical method. 2023 is shaping up as a inventory pickers industry. A easy program of using rewarding bullish positions in great shares AND at the exact time having bearish positions in bad stocks would make extra feeling than ever. This type of well balanced technique will possible proceed to outperform in what looks probably to be a hard 2023. Read through on down below to discover out additional.

Options. Implied Volatility. A lot of traders’ eyes glaze over making an attempt to comprehend what is assumed to be some thing way much too hard to at any time fully grasp.

In reality, even though, the ideas that comprise alternative trading are easier to fully grasp than you feel.

A walk by means of of what I take into consideration the most critical strategy, implied volatility (IV), will assistance prove this to you.

The most widely adopted evaluate of implied volatility is the CBOE Volatility Index (VIX). It steps a 30-day implied volatility for the S&P 500 Index.

Numerous of you are very likely familiar with the VIX from hearing it reviewed on the major economic information networks. In point, I converse about the VIX on a weekly foundation on CBOE-Tv set “Vol 411”.

Folks look at the S&P 500 as a benchmark for how inventory charges are generally performing. In a comparable vein, possibility traders search at the VIX as a benchmark of how option costs are carrying out.

A better VIX usually means extra high-priced options. A reduced VIX usually means choice costs are more affordable. So implied volatility is just a fancy way to say ”the price of the option”.

Implied volatility can be believed of the exact same way we feel of insurance rates:

- Risk-free and continuous motorists have lower motor vehicle coverage rates. Secure, regular, and lower volatility shares have decreased solution rates.

- Crazy and reckless motorists have significantly higher premiums. Wilder, greater volatility shares carry much larger selection premiums.

So it’s no surprise that option rates are referred to as selection premiums and that numerous portfolio professionals will get downside places as insurance coverage to safeguard their portfolios from decrease charges.

There are six parts that are employed to price tag possibilities:

- Stock Rate

- Strike Price tag

- Expiration date

- Recent Interest Amount

- Dividends (if any)

- Implied Volatility (IV)

The 1st five are recognized. You can seem at your trading display and see the inventory price tag, strike rate, days to expiration.

Curiosity costs and dividends are quickly identified by executing a google search. The only unfamiliar is implied volatility.

As explained earlier, implied volatility is just the price tag of an alternative. No need to do the fancy math or the calculations revealed under to realize IV.

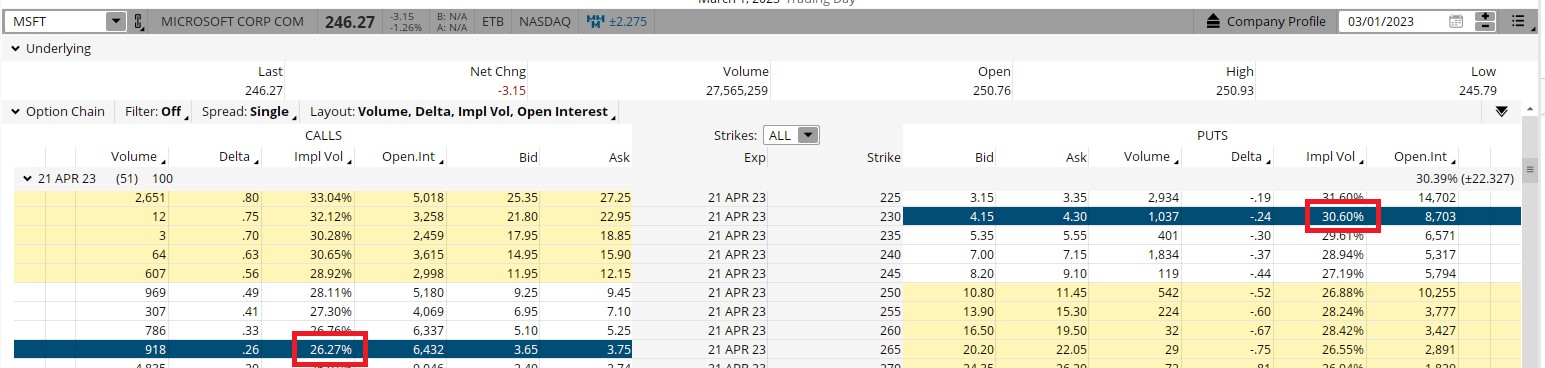

Implied volatility is called implied since it is the volatility enter desired to match the rate of the option to the price tag it is presently buying and selling. A appear at Microsoft (MSFT) solutions demonstrates the implied volatility for the distinct strike rates.

Take note how various strikes of the exact same expiration day – April 21 in this instance- have distinct implied volatilities. This is referred to as the solution skew.

An critical takeaway is that out-of-the-money puts pretty much constantly trade at a higher level of implied volatility in contrast to equivalent out-of-the-money phone calls.

The MSFT $230 puts are priced at a 30.60 IV, whilst the $265 phone calls are priced a lot lower at a 26.27 IV as shown in crimson.

Both of those alternatives closed about $17.50 points out-of-the funds. Out-of-the funds refers to the variance involving the place the inventory is buying and selling and the strike selling price.

Places are out-of-the income if the strike value is beneath the recent inventory value. Phone calls are out-of-the income if the strike value is over the present stock price tag.

In this occasion, the $230 puts were $17.27 details down below the closing price of Microsoft ($246.27-$230)-or out-of-the revenue by that amount of money. The $265 calls were being out-of-the income by $17.73 points.

The key reason for this distinction in IV is the truth that shares are inclined to drop a lot more swiftly than they rise. So downside places are additional beneficial than upside phone calls.

Implied volatility tends to be substantially higher in front of earnings and other company activities. This helps make sense considering that a likely massive transfer in the inventory price is looming.

Implied volatility usually falls next the earnings launch or company announcement as the unidentified results in being regarded.

Acquiring a improved comprehension that superior implied volatility suggests greater selection costs can be vital when considering possible trades. Shelling out a better option cost suggests you want a bigger transfer in the stock to justify the trade.

In my POWR Choices services I always do an in-depth implied volatility assessment, alongside with utilizing the POWR Rankings and complex investigation as section of the plan era approach.

It is just as crucial for person traders to normally think about amounts of implied volatility when considering their trades as nicely.

Implied Volatility as a Industry Timing Resource

Implied volatility can be utilized to detect probable turning details in the industry. This is specifically legitimate when implied volatility spikes to extremes.

The charts beneath demonstrates the VIX on the top and the S&P 500 (SPY) on the bottom. Observe how the past spikes in VIX (highlighted in blue) eventually signaled sizeable small-expression bottoms in the S&P 500.

Extensive durations of lower degrees in the VIX are a indication of complacency, which usually are a responsible indicator of brief-expression marketplace tops, as seen in purple. The most the latest offer signal was a signal of that.

The previous Warren Buffett adage, to be “fearful when others are greedy and greedy when others are fearful,” applies perfectly to this VIX sector timing methodology.

Trading, as we know, is all about probability, not certainty. Knowing and making use of implied volatility to set all those possibilities in your favor can be a precious addition to your trading toolbox. In POWR Solutions it is a person of the most critical equipment we use.

What To Do Future?

If you’re on the lookout for the greatest possibilities trades for today’s market place, you must undoubtedly check out this crucial presentation How to Trade Options with the POWR Scores. In this article we clearly show you how to continually uncover the prime choices trades, although reducing risk.

Applying this simple but effective system I have shipped a current market beating +55.24% return, considering that November 2021, whilst most traders have been mired in heavy losses.

If that appeals to you, and you want to study much more about this potent new solutions approach, then simply click underneath to get entry to this timely expenditure presentation now:

How to Trade Solutions with the POWR Rankings

Here’s to great trading!

Tim Biggam

Editor, POWR Choices E-newsletter

SPY shares rose $.24 (+.06%) in right after-hrs investing Friday. Year-to-date, SPY has attained 5.69%, as opposed to a % rise in the benchmark S&P 500 index all through the identical period.

About the Writer: Tim Biggam

Tim put in 13 several years as Main Choices Strategist at Male Securities in Chicago, 4 years as Direct Possibilities Strategist at ThinkorSwim and 3 many years as a Sector Maker for Initial Options in Chicago. He helps make regular appearances on Bloomberg Television and is a weekly contributor to the TD Ameritrade Community “Morning Trade Are living”. His overriding passion is to make the complicated planet of choices additional understandable and therefore much more beneficial to the day-to-day trader.

Tim is the editor of the POWR Options publication. Study much more about Tim’s history, together with backlinks to his most current content.

Far more…

The submit #1 Rule for Thriving Possibilities Trading appeared initial on StockNews.com