[ad_1]

How to ability up the POWR Pairs Trades to lower threat and improve return in a large vary, no alter sector natural environment.

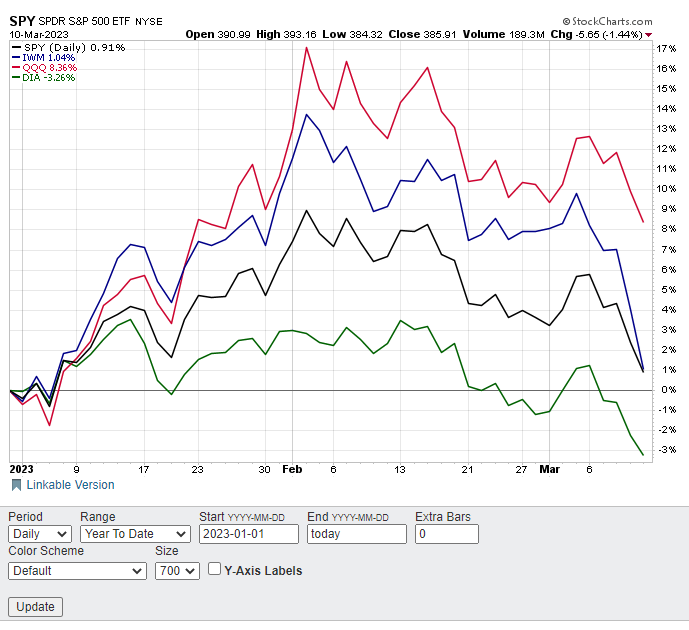

Following a rip-roaring start out to 2023, stocks have appear crashing back to fairly much unchanged on the calendar year.

The NASDAQ 100 (QQQ) however is up properly so much in 2023 at a minor over 8%, but that is extra than a 50% drop from the highs in early February. The S&P 500 (SPY) and Russell 2000 (IWM) have fallen further more and are clinging to slight gains for the 12 months. The Dow Jones Industrials (DIA) are now firmly in detrimental territory in 2023.

The roles had been reversed in 2022 with the DIA staying by far the ideal performer (down just below 14%) of the 4 indices when QQQ (down about 25%) was the worst.

This sort of significant variety, no transform sector surroundings would make obtaining shares a lot more challenging and puts a definite top quality on stock picking. Working with the POWR Scores to uncover the very best shares to purchase and the worst stocks to offer will be an even determined edge in 2023.

That’s exactly the method we have utilised with excellent results in POWR Possibilities. A POWR Pairs Trade to coin the phrase.

We begin by seeking at bullish calls on the highest rated shares and bearish places on the cheapest rated stocks. This eradicates substantially of the general marketplace exposure and distills the relative effectiveness down to the power of the POWR rankings. Better rated shares outperform reduce rated shares to a substantial diploma as proven in the chart under.

Then we determine scenarios wherever the lessen rated stock has out-done the greater stock in a significant way and is in a place to profit from the envisioned convergence of the two again to a far more traditionally conventional connection. In the previous, we invariably applied this pairs philosophy with two stocks in the exact same market to more dampen possibility.

We also always take into account implied volatility (IV) in each buying and selling decision. POWR Possibilities buys comparatively low cost options to additional put the general odds in our favor.

In our newest POWR Pairs Trade, having said that, we made the decision to forego the exact same industry prerequisite and just appear at acquiring fantastic shares doing awful and shorting poor shares executing as well excellent.

It ended up being a incredibly practical more method to our pairs investing philosophy. A rapid walk-via our newest POWR Pairs Trade will help drop some light-weight.

When not a “common” pairs trade, since the two shares are in different industries, it still is a POWR Rankings functionality pairs trade.

Purchasing bearish puts on the significantly lower-rated but a lot superior executing Alcoa (AA) and buying bullish phone calls on the considerably better-rated but a great deal lower performing Bristol-Myers Squibb (BMY).

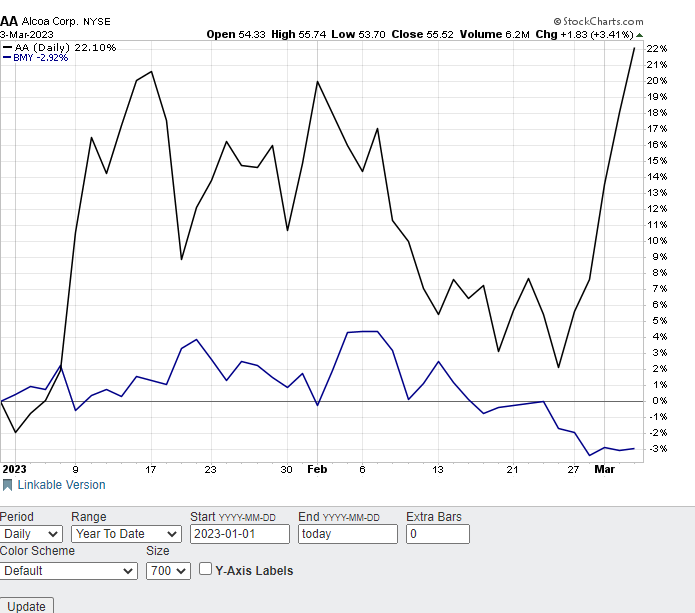

D rated -Promote- Alcoa (AA) is investing at annually highs for 2023, up 22%.

A rated -Sturdy Obtain-Bristol Myers (BMY) is just off the yearly lows, down about 3% 12 months-to-date.

The chart underneath shows the comparative efficiency so far in 2023. Take note how AA did fall sharply in February whilst BMY hugged the flatline. Given that the conclusion of February, even so, AA has exploded higher as soon as again even though BMY has drifted decrease. Overall performance differential acquired to 25%.

Glance for AA to be a relative underperformer to BMY around the coming weeks as the value effectiveness in between the two shares converges as it has in the previous.

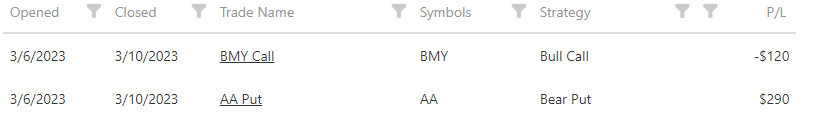

On March 3, The POWR Options portfolio purchased the AA June $50 places for $3.90 ($390 for every alternative) and at the exact same time purchased the BMY June $67.50 phone calls for $4.20 ($4.20) for each alternative. Overall put together outlay was $810.

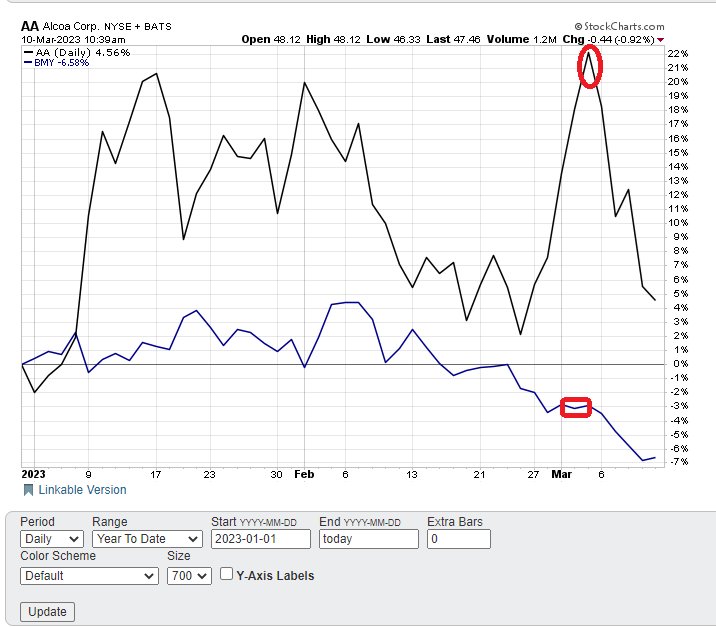

Fast forward to Friday March 10. You can see how AA has dropped above 17% due to the fact the pairs trade was initiated (highlighted in red). BMY has fallen as effectively, but only a little around 3.5%.

This led to closing out the pairs trade given that the unfold had converged dramatically. The unique general performance differential of about 25% on March 3 shrank, or converged, by much more than half to just more than 11% on March 10.

Just as importantly, implied volatility rose in that time body. This gave a elevate to each our extended puts on AA and lengthy phone calls on BMY. The AA puts went from a 53.81 IV to a 56.30 IV. The BMY Calls rose from a 21.14 IV to a 22.28 IV.

Exited the bullish BMY phone calls for a reduction of $120. Bought out of the bearish AA puts for a achieve of $290. Net over-all gain was $170 ($290 -$120). Genuine trade data observed underneath.

Internet percentage achieve on the trade was just in excess of 20% ($170 net acquire/ $810 original merged outlay). The keeping period was just a 7 days. In on Monday, out on Friday.

Investors and traders searching to generate related small-hazard but reliable quick-time period returns may possibly want to take into consideration employing the POWR Pairs Trade technique to appreciably lessen the downside but still depart plenty of upside open up for grabbing gains.

What To Do Up coming?

When the principles driving choices trading are simpler than most individuals realize, implementing those ideas to persistently make profitable alternatives trades is no effortless process.

The answer is to let me do the challenging work for you, by starting up a 30 day to my POWR Solutions newsletter.

I’ve been uncovering the finest solutions trades for above 30 several years and with the quantitative muscle mass of the POWR Rankings as my commencing place I have reached an 82% get amount around my very last 17 closed trades!

All through your demo you are going to get comprehensive obtain to the latest portfolio, weekly market commentary and each and every trade warn by text & email.

I am going to be incorporating the following 2 exciting selections trades (1 contact and 1 place) when the marketplace opens this Monday morning, so start out your demo now so you really don’t overlook out.

There is certainly no obligation past the 30 day demo, so there is certainly no danger in getting started these days.

About POWR Choices & 30 Day Demo >>

Here’s to very good trading!

Tim Biggam

Editor, POWR Alternatives Newsletter

shares shut at $385.91 on Friday, down $-5.65 (-1.44%). Year-to-date, has obtained .91%, vs . a % rise in the benchmark S&P 500 index in the course of the similar interval.

About the Creator: Tim Biggam

Tim put in 13 many years as Chief Selections Strategist at Gentleman Securities in Chicago, 4 years as Direct Selections Strategist at ThinkorSwim and 3 decades as a Sector Maker for To start with Solutions in Chicago. He can make standard appearances on Bloomberg Tv and is a weekly contributor to the TD Ameritrade Network “Early morning Trade Are living”. His overriding enthusiasm is to make the complicated earth of possibilities extra easy to understand and for that reason far more useful to the day to day trader. Tim is the editor of the POWR Possibilities publication. Find out more about Tim’s qualifications, together with links to his most new posts.

More…

The publish Better To Be Bullish Or Bearish? Being Both Is The Best Tactic appeared to start with on StockNews.com