2019 Survey

2017 Study

2016 Survey

[ad_1]

What with COVID, the economic system and the working day-to-issues of practicing legislation and managing a organization, it’s been a tough three yrs. But irrespective of it all, more compact regulation corporations have a bullish outlook on their long run prospects — and with excellent explanation.

So says the 2022 Condition of U.S. Smaller Regulation Companies survey conducted by Thomson Reuters, in collaboration with the American Bar Association’s Solo, Little Agency and Basic Exercise Division.

Virtually six in 10 legal professionals in little corporations — which the survey defines as individuals of 29 legal professionals or fewer — say they anticipate progress around the future 12 months in revenues for each law firm, billable several hours, and revenue for every law firm. Across each metric — billing costs, productiveness, realization prices — bigger quantities of attorneys assume to see average or superior progress more than the future year.

The exact same holds accurate for the future 3 many years, as little business legal professionals also be expecting significant-to-reasonable progress to keep on in revenues, revenue, demand from customers for solutions, and other metrics.

Supplied this optimism, it ought to not be stunning that modest company lawyers look at themselves prosperous. According to the study, 90% of compact organization legal professionals charge their companies as productive or quite prosperous. Significantly less than 1% characterize their agency as unsuccessful.

But the survey finds that there are variations in how corporations perspective their achievement centered on their measurement. For solos and corporations of 2-6 legal professionals, their analysis of their achievements dipped final calendar year but rebounded in 2022. For corporations of 7-10 lawyers, the proportion of legal professionals describing their company as very prosperous has steadily risen above the final three many years, from 29% to 35%. But for firms with amongst 11 and 29 attorneys, that percentage dropped from 39% to 23%.

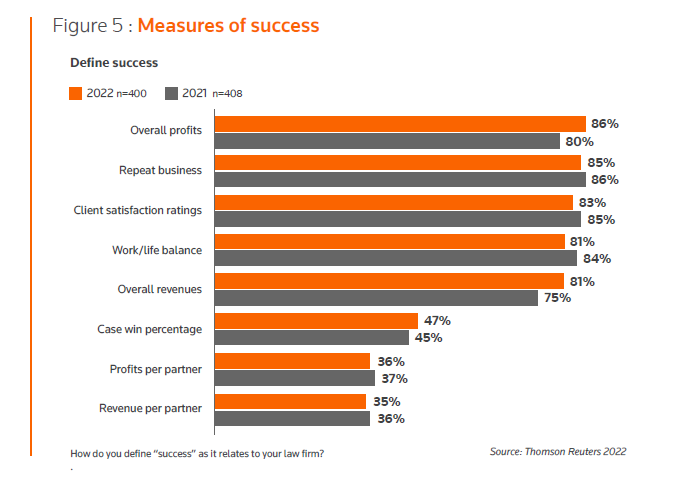

Of system, a firm’s evaluation of its accomplishment turns on how it steps achievements. In the 2021 survey, repeat enterprise was the most generally cited definition of achievements, followed closely by customer satisfaction scores and do the job/existence harmony. This yr, the most frequently pointed out evaluate of achievements was in general profits, followed by repeat company, consumer pleasure, and function/existence harmony.

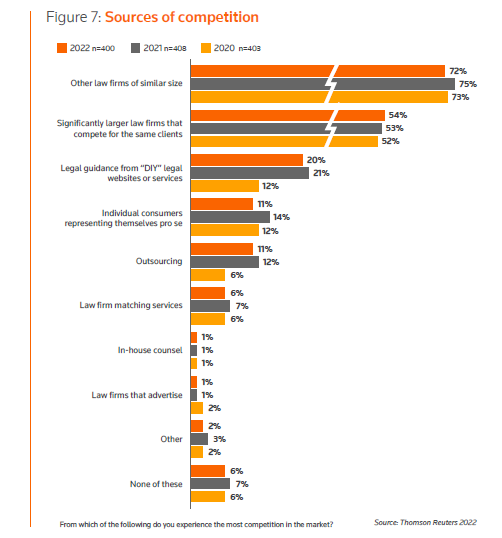

As in past yrs, the study finds that little corporations face opposition the two from higher than and below, in that they see their levels of competition not only as equally sized corporations, but also as bigger firms and self-help lawful websites.

“The escalating level of popularity of Do it yourself legal internet websites proceeds to encroach upon modest firms’ clientele,” the study identified. “The percentage of compact business legal professionals who perspective these kinds of sites as main opponents took a important soar in 2021 and has remained elevated in 2022. This kind of competitiveness — quickly available by way of personal computers and smartphones and viewed by customers as a fewer costly choice to legislation companies — is putting the onus on little regulation corporations to strengthen effectiveness and customer service.”

Even though companies are optimistic about their futures, they also identify that they experience difficulties. The study finds that the major problem tiny firms deal with is that of expending too a lot time on administrative duties and not ample time working towards regulation. The normal law firm lawyer spends just 56% of their time practicing law, down from 58% in 2020.

Other prime worries they most usually determined:

With regard to the challenge of rising fees, the most widespread approach by which companies answer is by growing their billing rates, followed by adopting new technologies, in accordance to the study. Other responses incorporate:

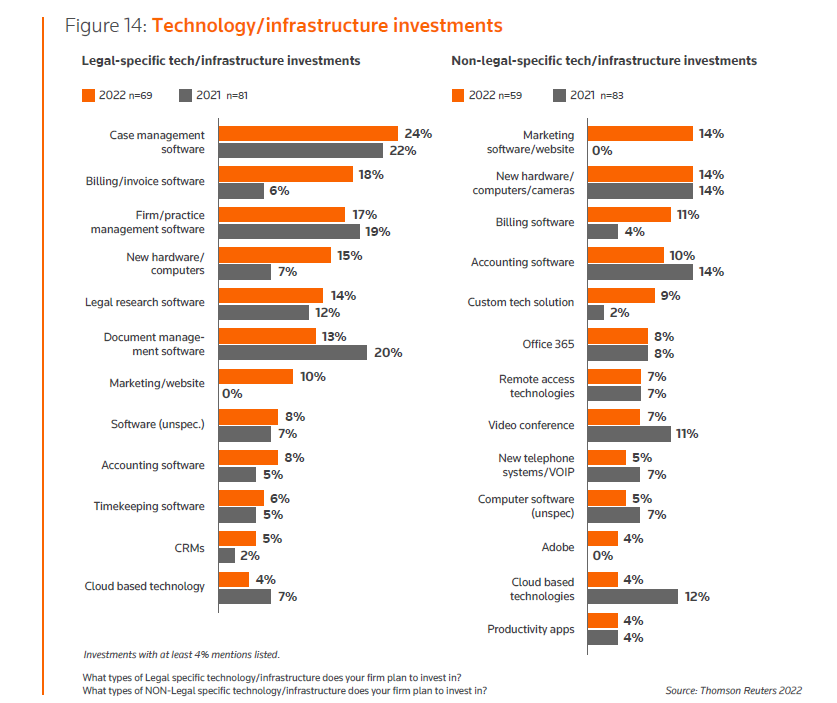

On the know-how front, the survey finds that little companies are either rising their tech devote or keeping the line. Amid a little bit much larger corporations, those people of 11-29 legal professionals, the proportion that increased their investment in tech just about doubled in 2022 to 38%, from 20% past calendar year. At the exact time, the amount of companies scheduling to decrease their tech expend fell from 8% in 2021 to 5% this calendar year.

Where are those tech bucks heading? Most normally to case management application, billing and invoicing software package, and follow administration software.

Some of it is also heading to non-lawful unique tech, this kind of as sites, hardware, and billing or accounting software program.

It is attention-grabbing that the study seems not to have questioned about digital payments technologies — a technological know-how whose use seems to have soared in recent years, in accordance to other surveys.

But the survey does locate that getting paid by shoppers is a lot less of a problem to little firms this calendar year. Whereas in 2020, 64% of corporations considered finding paid as a major to reasonable obstacle, this 12 months, that range has dropped to 54%. “And the part of companies with the finest urgency close to this situation, those who rated it as a substantial obstacle, has been cut by extra than half to just 9% from 19% in 2020,” the study claims.

“[T]in this article is emerging evidence that indicates little regulation firms are demonstrating their potential to rise to the obstacle and tackle some of their most pressing wants,” the report concludes. “Continuing to strategically emphasis on their objectives and the difficulties that could stand in their way will allow them to entirely capitalize on the growth chances that they are foreseeing.”

Past yrs of the survey:

2020 Survey

2019 Survey

2017 Study

2016 Survey